Rent-to-own agreements offer a path to homeownership that sits somewhere between renting and buying, but the financial reality is far more complex than many people realize. While these rent-to-own agreements can help you secure a home when traditional financing isn’t available, they often come with premium rent payments, upfront option fees, and maintenance responsibilities that can significantly impact your budget. The question isn’t whether rent-to-own agreements are good or bad—it’s whether the specific terms make financial sense for your situation.

What makes this decision particularly challenging is that rent-to-own agreements vary dramatically in structure and legal obligations. Some give you the flexibility to walk away if circumstances change, while others legally bind you to purchase regardless of market conditions or personal financial changes. The difference between a lease option and lease purchase can mean thousands of dollars and vastly different levels of risk. Understanding these distinctions, along with the true costs and potential pitfalls, is essential before you sign any agreement.

In the landscape of housing options, rent-to-own agreements stand out as a unique alternative that can provide a viable path to homeownership.

The Financial Mechanics: Understanding Cost Structures and Equity Building

Understanding rent-to-own agreements is crucial for prospective tenants to navigate these arrangements effectively. The nuances of rent-to-own agreements can often be overlooked, leading to misunderstandings regarding their financial implications. When evaluating rent-to-own agreements, it’s essential to consider the long-term financial commitment involved. Potential tenants often find that rent-to-own agreements require a thorough understanding of the associated costs and benefits. Evaluating the price-to-rent ratio in relation to rent-to-own agreements is an important factor in determining their viability.

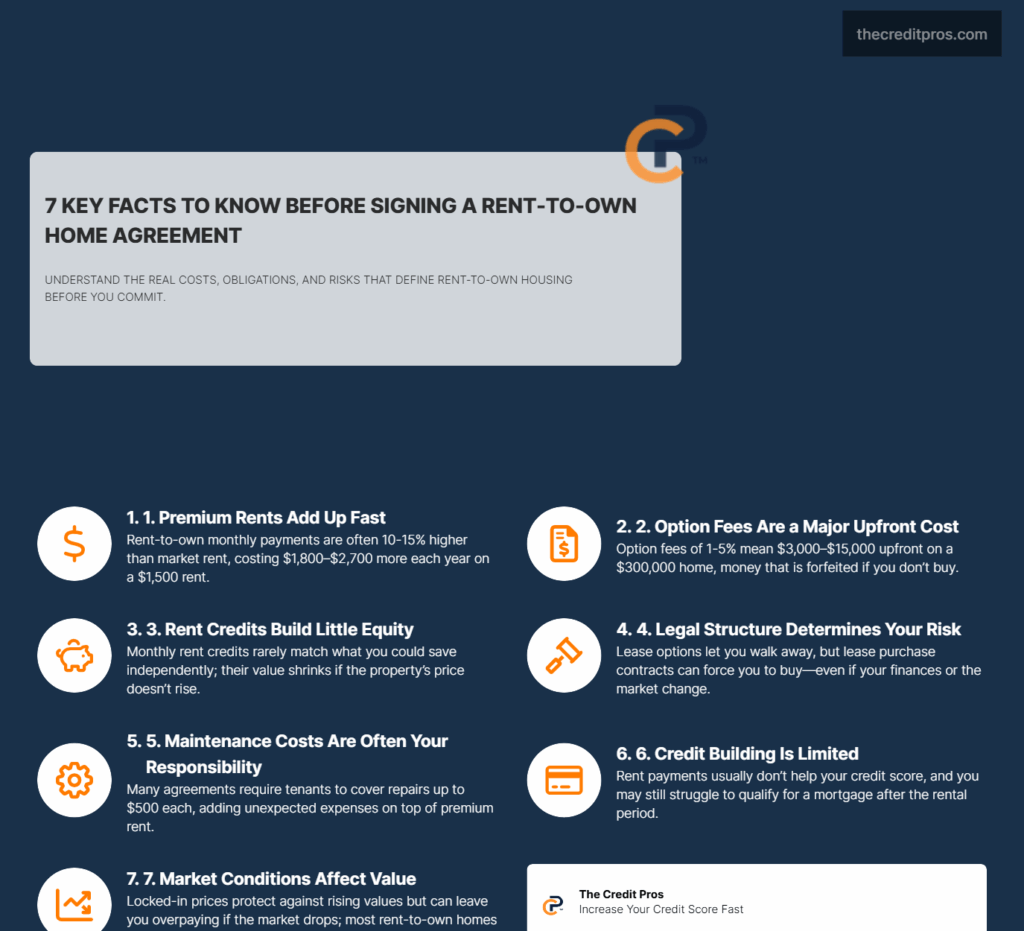

The premium rent structure inherent in rent-to-own agreements fundamentally alters the traditional cost-benefit analysis of housing decisions. When landlords charge 10-15% above market rates to account for the purchase option, tenants face an immediate financial burden that compounds over time. A $1,500 monthly market rent becomes $1,650-$1,725 under typical rent-to-own terms, creating an additional $1,800-$2,700 annual expense that must be weighed against the potential benefits of homeownership preparation.

Understanding the flexibility of rent-to-own agreements can significantly affect tenants’ decision-making processes. For many, the legal implications of rent-to-own agreements can be complex and require careful consideration. Before entering into rent-to-own agreements, it’s essential to clarify maintenance responsibilities to avoid unexpected financial burdens.

This premium pricing structure becomes more complex when you consider the opportunity cost of these additional payments. The extra $150-$225 monthly could alternatively be invested in high-yield savings accounts or used to accelerate debt repayment, potentially improving mortgage qualification prospects more effectively than the rent-to-own arrangement itself. The mathematical reality shows that traditional saving strategies often outpace the equity-building benefits of rent credits, particularly when considering the time value of money and compound interest.

Option fees ranging from 1-5% of the home’s purchase price represent another significant upfront investment that requires careful analysis. On a $300,000 property, this translates to $3,000-$15,000 paid immediately, money that becomes forfeit if the purchase doesn’t materialize. National Association of Realtors data showing median home prices of $353,900 means option fees could reach $17,695 at the upper range, representing a substantial financial commitment before any rent credits begin accumulating.

The rent credit mechanism, while appealing in theory, often provides less equity building than anticipated. When a portion of monthly rent applies toward the eventual purchase price, the effective rate of equity accumulation depends heavily on both the credit percentage and the locked-in purchase price. If market appreciation exceeds the rate of rent credit accumulation, the arrangement may provide genuine value. However, if property values stagnate or decline, tenants may find themselves paying premium rates for minimal equity benefits.

Many tenants are unaware of how rent-to-own agreements can complicate ownership objectives if title issues arise. As with all contractual agreements, understanding the risks associated with rent-to-own agreements is paramount. Identifying the challenges related to rent-to-own agreements can provide valuable insights for future homeowners.

The price-to-rent ratio calculation becomes particularly relevant in evaluating rent-to-own opportunities. When this ratio exceeds 15, traditional renting while saving for a down payment typically offers better financial outcomes. In markets where the median home price of $300,000 faces annual rents of $18,000, the ratio of 16.6 suggests rent-to-own arrangements may not provide optimal value, especially when factoring in the premium rent structure and opportunity costs.

Legal Structures and Contractual Obligations: Navigating Lease Options vs. Lease Purchases

The distinction between lease options and lease purchases creates vastly different legal and financial obligations that can determine the success or failure of these arrangements. Lease options provide tenants with the flexibility to walk away if circumstances change, market conditions shift, or the property proves unsuitable for long-term ownership. This optionality comes with the understanding that option fees and rent credits may be forfeited, but the legal obligation ends there.

Lease purchase agreements, conversely, create binding contractual obligations that can result in legal proceedings if tenants cannot complete the purchase as agreed. The legal ramifications extend beyond financial loss to potential court-ordered specific performance or breach of contract damages. These agreements favor sellers by guaranteeing a buyer, but they can trap tenants in situations where mortgage qualification becomes impossible or market conditions make the purchase financially disadvantageous.

Maintenance responsibility allocation within these agreements often shifts traditional landlord-tenant dynamics in ways that significantly impact total housing costs. Many rent-to-own contracts require tenants to handle repairs under specific thresholds, commonly $500, while landlords retain responsibility for major systems and structural issues. This arrangement means tenants may face unexpected expenses for appliance repairs, minor plumbing issues, or routine maintenance while paying premium rent and saving for eventual purchase.

“I’ve done rent-to-own deals on behalf of buyers as well as sellers over the years. In this market, where sellers are getting their asking price and sometimes more than their asking price, and homes are selling quickly, rent-to-own sales are not as common.”

— Gregg Wasilko, Real Estate Agent, Howard Hanna

The complexity increases when considering potential title and ownership complications during the rental period. If sellers face foreclosure, default on existing mortgages, or take out home equity loans against the property, tenants may find their rent-to-own agreements invalidated or complicated by senior liens. These scenarios can result in complete loss of option fees, rent credits, and the time invested in preparing for homeownership, with limited legal recourse for recovery.

Property encumbrances discovered late in the process can derail even well-structured agreements. Unpaid property taxes, contractor liens, or code violations may surface only when tenants attempt to finalize their purchase, creating delays, additional costs, or complete inability to complete the transaction. The legal framework surrounding these complications varies by state, making professional legal review essential for protecting tenant interests.

Credit and Mortgage Qualification Challenges: The Qualification Timeline Reality

The credit building limitations of rent-to-own arrangements present a fundamental challenge that many participants overlook. Unlike traditional mortgage payments, rent-to-own payments typically don’t appear on credit reports unless landlords specifically arrange for reporting, which occurs infrequently. This means tenants may spend years making premium payments without receiving the credit score benefits that could improve their eventual mortgage qualification prospects.

Employment stability requirements for mortgage qualification become particularly relevant during extended rent-to-own periods. Lenders typically require two years of consistent employment history, and job changes during the rental period can complicate final mortgage approval even if income levels remain stable or increase. The irony emerges when tenants who enter rent-to-own agreements due to employment instability face the same qualification challenges at the agreement’s conclusion.

The challenge of accumulating sufficient down payment funds while paying premium rent creates a financial squeeze that many tenants underestimate. Even with rent credits applied toward the purchase, most lenders require additional cash for down payments, closing costs, and reserves. FHA loans requiring 3.5% down on a $300,000 property still demand $10,500 plus closing costs, money that must be saved separately from rent credit accumulation.

Interest rate risk compounds these qualification challenges as credit scores and market conditions change during the rental period. Tenants who fail to improve their credit profiles during rent-to-own agreements may face higher interest rates when seeking final financing, potentially making the purchase unaffordable despite years of preparation. The difference between qualifying for a 4% versus 6% interest rate on a $300,000 mortgage represents over $350 in monthly payment variation.

“The terms of the agreement – how long and/or how much of their monthly rent goes to a down payment – is entirely negotiable between buyer and seller.”

Whether beneficial or burdensome, rent-to-own agreements are a significant investment that deserves careful consideration. The paradox of paying higher rent while trying to save for mortgage qualification creates a mathematical challenge that requires careful planning. When rent premiums consume $150-$225 monthly that could otherwise support savings goals, the path to mortgage readiness becomes longer and more complex. This dynamic particularly affects first-time buyers who already face challenges in accumulating down payment funds while managing current housing costs.

Market Risk and Alternative Strategy Evaluation: When Rent-to-Own Makes Sense

In conclusion, individuals should carefully weigh the pros and cons of rent-to-own agreements before making a commitment. Market volatility creates both opportunities and risks that significantly impact rent-to-own outcomes depending on timing and local conditions. Locked-in purchase prices provide protection against appreciation but create liability during market corrections. Tenants who agreed to purchase homes at 2021 peak prices may find themselves obligated to buy properties worth significantly less by agreement conclusion, while those who locked prices before recent appreciation may benefit substantially. Ultimately, assessing the implications of rent-to-own agreements can influence decision-making and financial planning. Rent-to-own agreements should be approached with caution, ensuring a thorough evaluation of all terms and conditions.

The correlation between rent-to-own availability and underlying property or market issues deserves careful consideration. In strong seller’s markets where homes receive multiple offers and sell quickly, property owners have little incentive to offer rent-to-own arrangements. The availability of these agreements often signals properties that have struggled to sell through traditional channels, potentially indicating location issues, condition problems, or pricing challenges that warrant investigation.

Current market conditions where sellers receive asking price or higher create an environment where rent-to-own agreements provide limited benefit to property owners. Real estate professionals note that these arrangements become more common when traditional sales prove challenging, suggesting that available rent-to-own properties may represent less desirable inventory or sellers facing financial pressure to generate immediate income while maintaining sale prospects.

Alternative homeownership strategies often provide better financial outcomes than rent-to-own arrangements. FHA loans enable qualified buyers to purchase with down payments as low as 3.5%, while first-time buyer programs offer down payment assistance, favorable interest rates, and reduced fees. These conventional paths avoid the premium rent structure and option fee requirements that characterize rent-to-own agreements.

The quantitative analysis comparing rent-to-own costs against traditional renting with aggressive saving reveals the mathematical reality of these arrangements. A tenant paying $225 monthly premium rent over three years spends $8,100 in additional costs, money that could alternatively accumulate in savings accounts earning interest. When combined with option fees, the total additional cost often exceeds the rent credits earned, particularly in stable or declining markets.

Due Diligence and Professional Guidance: Protecting Your Investment

Legal review by qualified real estate attorneys becomes essential given the complexity and variation in rent-to-own contract structures. These agreements involve elements of both rental and purchase contracts, creating hybrid legal documents that require specialized expertise to evaluate properly. Attorneys can identify problematic clauses, negotiate protective terms, and ensure compliance with state-specific regulations governing these arrangements.

Property inspection timing takes on heightened importance in rent-to-own scenarios where tenants may assume maintenance responsibilities during the rental period. Professional inspections conducted before signing agreements can reveal costly issues that could become tenant obligations, from aging HVAC systems to roof problems that may require expensive repairs. The inspection process should be more comprehensive than typical rental evaluations, approaching the thoroughness expected for purchase transactions.

Seller disclosure requirements vary significantly by state, but comprehensive disclosure becomes crucial when tenants plan eventual ownership. Property history, known defects, environmental concerns, and neighborhood issues all affect long-term ownership value and should be fully disclosed before tenants commit to purchase options. The legal framework for addressing undisclosed problems discovered during the rental period can be complex and costly to resolve.

Lender pre-consultation represents a critical step often overlooked by rent-to-own participants. Meeting with mortgage professionals before entering agreements provides realistic assessment of qualification probability and identifies specific steps needed to achieve mortgage approval. This consultation should include credit report review, income documentation analysis, and debt-to-income ratio calculations to establish a clear path toward qualification.

The relationship between property condition findings and maintenance responsibility negotiations becomes particularly important when inspection reveals deferred maintenance or aging systems. Tenants should negotiate clear boundaries around repair responsibilities, establish reserve funds for expected maintenance, and create mechanisms for addressing major system failures during the rental period. These negotiations protect against unexpected expenses that could derail purchase plans or create financial hardship during the agreement term.

Making Your Rent-to-Own Decision: Weighing the True Costs

Rent-to-own agreements aren’t inherently good or bad financial decisions—they’re complex arrangements that require careful evaluation of your specific circumstances, market conditions, and the agreement’s terms. The premium rent structure, option fees, and maintenance responsibilities can significantly impact your budget, while the distinction between lease options and lease purchases creates vastly different levels of risk and obligation. When you factor in credit building limitations, mortgage qualification challenges, and the opportunity costs of alternative strategies, the mathematical reality often favors traditional saving approaches over rent-to-own agreements.

The key to making an informed decision lies in understanding that rent-to-own agreements work best for a narrow set of circumstances: when you have stable employment, clear credit improvement plans, and access to properties that genuinely offer value through locked-in pricing in appreciating markets. Professional legal review, comprehensive property inspections, and realistic mortgage pre-qualification assessments become essential protective measures. Before you commit thousands in option fees and premium rent payments, ask yourself this critical question: Are you choosing rent-to-own agreements because it’s the best path to homeownership, or because you haven’t fully explored the alternatives that might serve your financial future better?